Mortgage Refinancing Drops to An All-Time Low This Decade

The rates of interest for mortgages have increased almost every week in 2018 leaving homeowners with fewer incentives for refinancing their mortgages. The volume of mortgage applications remains at it’s constant best from the week earlier according to information provided by the Mortgage Bankers Association. The share of refinancing mortgages has however fallen by 40% which is the lowest after 2008.

With an increase being observed for the interest rates for home loans every week in the current year, homeowners are finding they have fewer reasons to refinance whatever mortgages they have. Another drop was seen in mortgage refinancing a week earlier but the market managed to keep the volume of fresh mortgage applications fundamentally the same and higher by 0.9% which is seasonally adjusted over the last week according to the information provided by the Association.

With an increase being observed for the interest rates for home loans every week in the current year, homeowners are finding they have fewer reasons to refinance whatever mortgages they have. Another drop was seen in mortgage refinancing a week earlier but the market managed to keep the volume of fresh mortgage applications fundamentally the same and higher by 0.9% which is seasonally adjusted over the last week according to the information provided by the Association.

The normal agreed interest rate for 30-year mortgages at a fixed rate with corresponding loan balances of $453,100 witnessed an increase from 4.65% to 4.69% while the points decreased from 0.58 to 0.45 including a fee for 80% loan to value ratio loans. The figure mentioned is at it’s highest since January 2014.

Are Higher Rates of Interest are Keeping People Away From Refinancing Mortgages

A drop of 2% has been witnessed for the week in the number of applications for refinancing mortgages because of the higher interest rates which are presently applicable compared to 18% a year earlier when interest rates were affordable. The share of refinancing applications for mortgages dropped by 40% which is the lowest after 2008. Applications for mortgages needed to purchase homes, however, managed to improve slightly showing an increase of 3% in the week which is also higher by 3% last year.

Supplies have been constraining the buying market but it has not proved to be a dampener for people who are submitting applications for fresh home loans. The numbers have increased to soaring levels in just a month because economic and demographic conditions continue to be favorable for the demand seen for homes according to economist Joel Kan.

The lack of ready-possession homes offered for sale is perhaps encouraging more homebuyers to begin viewing fresh projects. Mortgage applications for the purchase of freshly built homes increased by 4.6% in February as compared to a year earlier.

Homeownership today is far more expensive than it had been over the last decade and also easier to obtain. According to realtor.com, the mean monthly mortgage payments are now up by nearly 13% than just a year ago indicating a mix of higher prices for homes and higher rates of interest too.

Demand for Homes Has Not Diminished

The demand for houses is significant and a number of buyers are compelled to look at new projects because they cannot find homes on the lower spectrum of the market because of lean supply. Homebuyers are left with no options but to increase their budgets if possible, as well as begin paying the higher interest rates which are being demanded. This is ending in less sales in the property market.

Home buyers may presume that a higher portion of their salaries will go into making their mortgage payments for the remainder of this year confirms Danielle Hale, the chief economist of realtor.com, who mentions that homebuyers this spring have a decision to make on their hands. Are they willing to forgo some of the desired features in their new home to get into a price range which is lower or are they willing to reach further into their wallets to purchase a home they desire?

Regardless of the choices made by homebuyers, the only certainty remains in the fact that they will be required to pay higher interest rates that can possibly make them cut back on other expenditure. People looking forward to refinancing their mortgages will have no options but to either accept the higher figures being charged or give up on their attempts to get additional financing on their mortgage.

This is a clear indication that people are no longer willing to stretch themselves thin and pay higher interest rates on mortgage refinancing, perhaps because they do not see a positive outcome from the economy. It is quite possible that people could be waiting to ascertain the situation before deciding on the best option available to them.

More inFinancial Adviser

-

Fun and Exciting Things to Do When You’re Bored With Friends

Ever feel that awkward silence creeping in during a hangout with your friends? Been there, done that! We all know the...

June 4, 2024 -

What Is Equity in Business? Here’s What You Need to know

When embarking on the journey of growing a business, it’s crucial to grasp the concept of equity. So, what is equity...

June 2, 2024 -

Here Are the Best Saving Money Challenge to Boost Your Bank Balance

Ever feel like saving money is a daunting task? Imagine turning it into a fun game or a friendly competition! This...

May 25, 2024 -

Is Cardi B Dominican? The Star Sets the Record Straight on Her Identity

In the vibrant world of social media, where every aspect of a celebrity’s life is scrutinized, Cardi B recently took a...

May 19, 2024 -

Why Is It Important to Reconcile Your Bank Statements? The Ultimate Guide

Why is it important to reconcile your bank statements? Many business owners view bank statement reconciliation as a tedious task. However,...

May 12, 2024 -

Unlock Free Trips By Paying Mortgage & Loans with Credit Cards

Making large payments wouldn’t have been easier if it weren’t for credit cards. The system ensures full safety and quick transfer....

May 2, 2024 -

Skimpflation: Is Luxury Losing Its Luster?

In the glamorous world of luxury, a quiet revolution is underway, and it goes by the name of ‘skimpflation.’ Imagine your...

April 26, 2024 -

Is WinCo Cheaper Than Walmart? A Detailed Comparison

When you think of grocery shopping on a budget, Walmart probably comes to mind as a go-to destination. But have you...

April 23, 2024 -

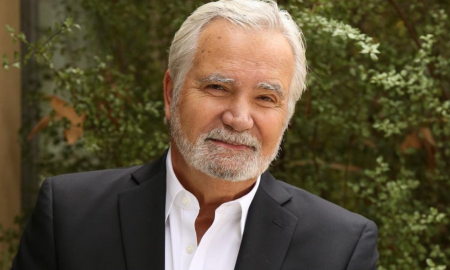

Is John McCook retiring? Actor Opens up About Future Plans

When a bombshell diagnosis rocked “The Bold and the Beautiful” (B&B) and landed on Eric Forrester, played by the iconic John...

April 16, 2024

You must be logged in to post a comment Login