Things That You Should Not Take out A Loan for

There are things that are not only pointless to take out loans for, but also dangerous for personal finances.

It often happens that a person gets a good salary, but still lives from salary to salary, and even does constantly borrow money – from banks or from acquaintances. They have consumer loans, loans for car purchases and mortgages, and sometimes it happens without them noticing it.

Sometimes the big expenses are aimed at creating an image of a successful person who wants to use the phone and the car of the last model, to dress from the luxury stores and wear expensive watches.

Often people make an excuse that loans taken for a toaster are called “it’s easier for me to pay a bank than to save myself”. As a result, payments on numerous loans exceed the recommended 25-30% of the family budget.

Credit is a good tool that helps in certain or extreme cases. For example, buy an apartment or buy a car, find money for emergency treatment or education for children. But there are things that are not only pointless but also dangerous for personal finances.

Loan for A Wedding Or Other Celebration

Even if you are given a lot of money, it is not likely to cover your spent money. This is the case when the loan is the most senseless for your budget. Even if you are not planning on inviting celebrities to sing for your son’s wedding, you are still going to end up paying lots of money. Taking a loan for wedding simply means creating a new family life with the burden of debts, which will need to be paid for more than one year. Even if all guests bring money in envelopes as presents, you will still have quite a big amount of debt. So consider things before taking a credit for your wedding celebration.

Even if you are given a lot of money, it is not likely to cover your spent money. This is the case when the loan is the most senseless for your budget. Even if you are not planning on inviting celebrities to sing for your son’s wedding, you are still going to end up paying lots of money. Taking a loan for wedding simply means creating a new family life with the burden of debts, which will need to be paid for more than one year. Even if all guests bring money in envelopes as presents, you will still have quite a big amount of debt. So consider things before taking a credit for your wedding celebration.

Loan for A Trip

The money spent still needs to be returned, and the loan will make a vacation at least 20% more expensive.

Secondly, banks give out purposeful loans for vacation reluctantly, therefore, most likely, it is necessary to take the credit in cash at a higher interest. But even if you as an ideal borrower are given a loan for vacation, you cannot do without collecting a whole heap of documents, certificates, then wait for approval – and perhaps get refused, and during this time a profitable tour will triple in price or run out of tickets for the plane. Remember that banks study both the client and credit history, which takes time.

Loan for A New Smartphone, TV Or Any Other Home Appliance

The new model will be released faster than you can pay for the loan for a year or two. This is one of the most senseless loans. The equipment can break before you even pay off for it. And an “interest-free loan” can be a trick to hide a 10-20 percent commission of a store or bank that is not returned to you. In any case, a new phone or a coffee grinder will cost you much more than you could pay, just by accumulating the right amount.

Loan for Home Repairs

Firstly you cannot accurately calculate the cost of repair in advance (unless, of course, you are a professional designer or builder). As they say, repairs cannot be completed, it can only be suspended, and it can be compared to a natural disaster that draws the last money from the family budget. And if a loan has been issued for a part of the work, then it is possible that you may find yourself in a debt hole. It might be needed to take a new loan to continue, for example, to glue the wallpaper or not to stop halfway the replacement of plumbing in the bathroom.

Firstly you cannot accurately calculate the cost of repair in advance (unless, of course, you are a professional designer or builder). As they say, repairs cannot be completed, it can only be suspended, and it can be compared to a natural disaster that draws the last money from the family budget. And if a loan has been issued for a part of the work, then it is possible that you may find yourself in a debt hole. It might be needed to take a new loan to continue, for example, to glue the wallpaper or not to stop halfway the replacement of plumbing in the bathroom.

Secondly, even if the interest rate on such loans is low in case you deposit in real estate, there is a chance to lose it if something goes wrong.

Loan for Jewelry Or Art

If investing in gold, silver is a sensible idea, then the purchase of jewelry can hardly be attributed to a reasonable investment of your money. Firstly, if you are not a specialist in jewelry (or not an art critic), then the seller is likely to try to deceive you and inflate the price with a high probability. And even if you buy rings and bracelets in a reputable jewelry store, most pawnshops in crisis situations will take your expensive jewelry at the price of scrap metal. Secondly, even an engagement ring is not an object of first necessity, and its purchase can be postponed until better financial times. And, thirdly, if the jewelry is really expensive, it should be stored in a safe or in a bank. And you will again need a considerable amount for this. Is it really necessary to take credit for this?

More inFinancial Adviser

-

Fun and Exciting Things to Do When You’re Bored With Friends

Ever feel that awkward silence creeping in during a hangout with your friends? Been there, done that! We all know the...

June 4, 2024 -

What Is Equity in Business? Here’s What You Need to know

When embarking on the journey of growing a business, it’s crucial to grasp the concept of equity. So, what is equity...

June 2, 2024 -

Here Are the Best Saving Money Challenge to Boost Your Bank Balance

Ever feel like saving money is a daunting task? Imagine turning it into a fun game or a friendly competition! This...

May 25, 2024 -

Is Cardi B Dominican? The Star Sets the Record Straight on Her Identity

In the vibrant world of social media, where every aspect of a celebrity’s life is scrutinized, Cardi B recently took a...

May 19, 2024 -

Why Is It Important to Reconcile Your Bank Statements? The Ultimate Guide

Why is it important to reconcile your bank statements? Many business owners view bank statement reconciliation as a tedious task. However,...

May 12, 2024 -

Unlock Free Trips By Paying Mortgage & Loans with Credit Cards

Making large payments wouldn’t have been easier if it weren’t for credit cards. The system ensures full safety and quick transfer....

May 2, 2024 -

Skimpflation: Is Luxury Losing Its Luster?

In the glamorous world of luxury, a quiet revolution is underway, and it goes by the name of ‘skimpflation.’ Imagine your...

April 26, 2024 -

Is WinCo Cheaper Than Walmart? A Detailed Comparison

When you think of grocery shopping on a budget, Walmart probably comes to mind as a go-to destination. But have you...

April 23, 2024 -

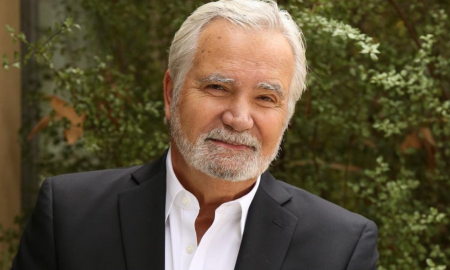

Is John McCook retiring? Actor Opens up About Future Plans

When a bombshell diagnosis rocked “The Bold and the Beautiful” (B&B) and landed on Eric Forrester, played by the iconic John...

April 16, 2024

You must be logged in to post a comment Login